Posted on: 11/07/2023

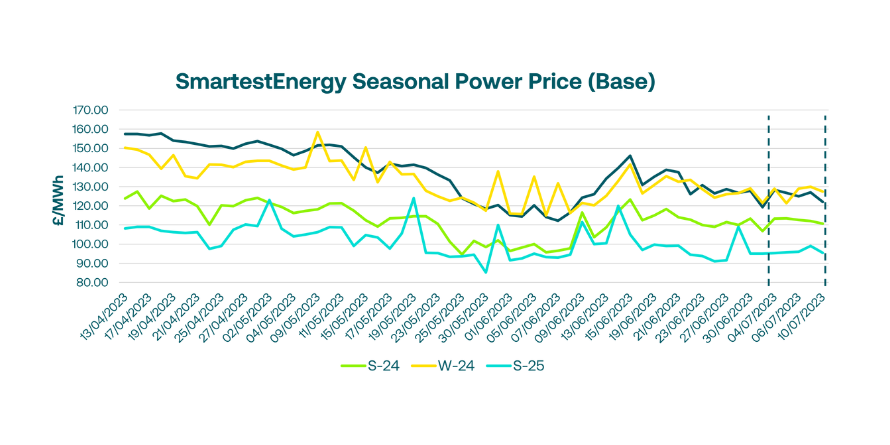

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 4th – 10th July 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £128.24/MWh for the Winter-23 seasonal power price on 4th July. In this blog, Fanos shares the market news and updates from the last week.

Last week, we saw improved supply across Europe, with Norwegian gas maintenance plans nearing completion and expectations of increased solar and wind generation to reach higher than seasonal normal levels. Despite the healthy supply outlook, minimal power volume traded across all UK forward periods, registering a fall in Winter-23 UK power, whilst NBP gas registered a daily gain. Spark spreads were also down, with almost a £2.50 decline following the previous day’s UKA-led rally.

Into the week, Norwegian gas flows increased following the partial completion of maintenance, whilst demand remained level. Gas and power traded in a relatively narrow range, with mainly front month, quarter and season contracts trading on the UK power curve. Spark spreads continued to fall, with the Winter-23 clean spark spread reduced to £8.25, in comparison to £10.00 last Friday and £24.00 back in May.

Continued improved supplies via Norway and softening industrial demand across Europe saw gas and power prices fall towards the end of the week. Short-term fundamentals indicated a long UK and European system, with weak demand and strong supply expectations, whilst the longer-term outlook appeared healthy, with storage levels continuing to increase in readiness for winter.

Yesterday, European gas slipped to a 1-month low amid healthy storage levels, strong supply and slowing seasonal demand. UK power fell in tandem, with the front two seasons falling by €6/MWh.

United States

United States Australia

Australia