Posted on: 26/09/2023

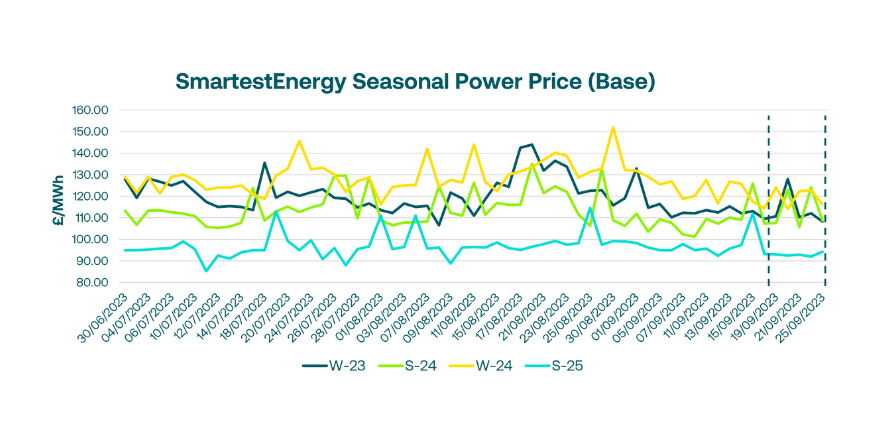

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 19th September – 25th September 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £128.00/MWh for the Winter-23 seasonal power price on 20th September. In this blog, Fanos shares the market news and updates from the last week.

Last Tuesday, supply opened stable to the previous day, with the expectation that Norwegian flows from Troll would resume. However, flows failed to materialise, and markets responded cautiously, trading up across Winter-23. Meanwhile, China’s Sinopec Corporation secured 30 LNG cargoes for October 2023 to the end of 2024 to cover winter demand and increase inventories, which indicates a potential supply gap for Europe this winter.

Into the week, the UK gas system opened short, falling to 26mcm on Thursday, amid cooler temperature outlooks, heating load pick up and reduced flows to the UK. An announcement from Chevron accepting the Australian LNG arbitration recommendations saw a brief sell-off in the Winter-23 contract, with baseload power trading down to £108. However, the trend was short-lived, and NBP Winter-23 gas firmed to close nearly 4p up on the previous day’s closing level.

On Friday, in Australia, finally, both sides agreed to accept the proposal at both LNG facilities, whilst an Australian union alliance followed Chevron’s earlier acceptance. Meanwhile, extended Norwegian outages drove prices up, mainly affecting front-month contracts.

This week, markets opened strong following a weekend of maintenance program outage updates from Norwegian gas system operator Gassco. News of an extension to the Skarv gas field shutdown also came in over the weekend, with the shutdown initially extended to 2nd October and then further extended to 8th October yesterday morning.

Whilst European storage inventories sit significantly above their mandated 80%, currently at 94.7%, risk premiums were extended, and both in the short term, the front month and curve beyond all saw gains. Expectations of warmer than seasonal average temperatures added some respite, but overall, supply risks and thin liquidity supported the bullish trend.

United States

United States Australia

Australia