Posted on: 14/09/2021

On Monday 13th September, we saw new records across the global commodities markets. Jean-Philippe Marty, Sales Trader, talks us through the volatile market activity seen across the gas and power markets yesterday.

Yesterday was a day of records! Here's a snapshot of the volatility we saw across the global gas and power markets.

As supply outlook remains weak, the main EU gas hub, TTF (Title Transfer Facility) for Winter-21 reached an all time high of €61.595/MWh. Meanwhile the front month TTF was around $2/MMBtU premium to U.S gas liquefied and delivered to JKM(Japan/Korea Marker) via LNG tanker..

The U.S. gas Henry Hub, reached a 7-year high as air conditioning induced demand remains strong, while some gas production remains shut from Hurricane Ida’s damage.

The National Balancing Point, commonly referred to as NBP for Winter 21 also reached new high at 158.75 GBp/therm, while Coal ARA (Amsterdam/Rotterdam/Antwerp) for Q4 2021 reached $170 per tonne.

For UK Power prices, Winter 21 Seasonal Baseload traded at £150/MWh and the base/peak widened significantly to -26.75, meaning Winter 21 Peak is now valued £26.75/MWh higher than baseload! (Usually, we'd see a more regular winter base/peak at around -8).

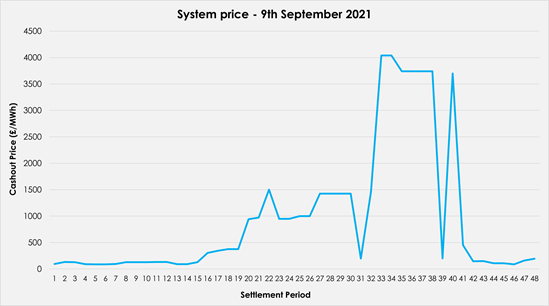

After last week's intraday mayhem where multiple system prices reached £4,000/MWh, prompt trading remains on the edge with Day-Ahead OTC Baseload reaching £540/MWh and Block 5 hitting £1,250/MWh. It then collapsed in the Nordpool N2EX Auction to £354/MWh on the base and £793/MWh on the peaks.

To conclude a record-breaking day, the Day-Ahead auction for today (14th September) cleared at £1,750/MWh for the period 19h to 20h - a new record since January 2021.

William Lake, Spot Trading Analyst, commented, "The spot markets have been extremely volatile, not only in the Day-Ahead market, but the Balancing Mechanism also spiked to £4,037.80/MWh on 9th September, which suggests generators are more active in the spot markets than wholesale market".

Stay tuned for our monthly power market blog that we'll be publishing on the 4th October, where we'll be recapping on the gas and power market activity for the whole month of September.

United States

United States Australia

Australia