Posted on: 28/03/2023

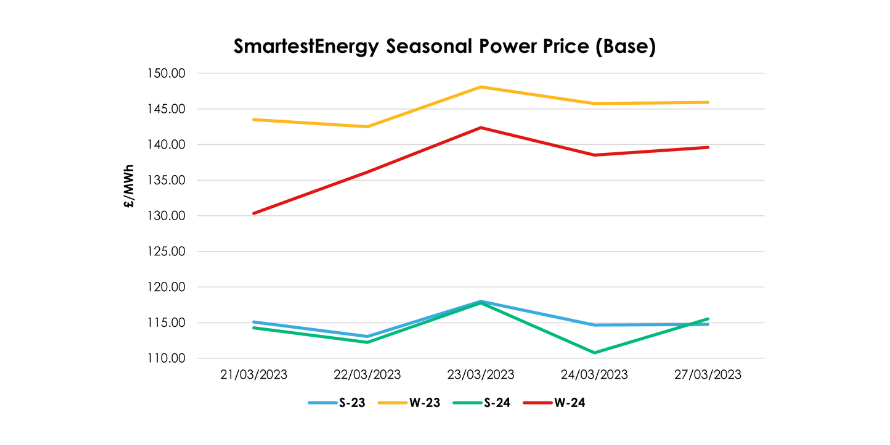

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 21st - 28th March 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £117.98/MWh for the Summer-23 seasonal power price on 23rd March, reducing to £114.75/MWh yesterday. In this blog, Fanos shares the market news and updates from the last week.

Last week, European gas bounced back from falling to 20-month lows following an unexpected reduction of operations at Angola LNG. Power prices also recovered, and carbon finally rallied following a 2-month low hit the day before, with most activity focused on Winter 23 contracts.

Mid-week, the UK gas system opened strong, but mild weather and strong wind output added downward pressure. However, on Thursday, European gas prices rose again amid less windy forecasts, and power also recovered, following the trend of the firm gas and emissions markets.

Throughout the week, the UK continued to receive a high number of LNG deliveries whilst the worker strikes in France limited LNG terminal receipts. The strike action has now been extended to 28th March and continues to affect the work and maintenance of nuclear power plants, alongside work at LNG terminals.

The banking sector also made headlines this week, with shares at Deutsche Bank dropping 14% on Friday, with an overall loss of 28% in March. Whilst many banks are affected across the globe as shares trade lower, the central banks carried on with interest rate hikes, causing uncertainty in the market.

At the beginning of this week, overall fundamentals for gas remain low, with warmer temperatures expected and inventories high. The prevailing risk to prices remains around the ongoing impasse in France between EDF and staff, with nuclear maintenance plans posing a risk to Winter 23 power prices.

United States

United States Australia

Australia