Posted on: 25/02/2021

Chief Technology Officer, Rob Pringle shares some expert intel on the complex nature of energy trading. He looks at the ever-increasing role of technology in enabling generators and consumers access to the traded energy markets, including the forward market and short-term markets like the Balancing Mechanism (BM).

As the energy system is changing at pace and the deployment of independent renewables increases to help meet ambitious net-zero targets, technology is key to serving our customers’ changing needs. Generators need to track market prices and respond to price spikes to lock in volume at the best price and tap into new short term and near real-time markets, such as the BM.

As a next generation energy company, SmartestEnergy has sought the knowledge and expertise of some of the sector’s most experienced technology providers, including: Jules Energy, who provide the platform our SmartFlex PPA Trading Portal is built on; Origami Energy, who provide us with the tools we need to manage and dispatch flexible assets in real-time; and Quorum, who provide trading support systems and algorithms to our Spot Trading team to help us get the best value for our customers.

Providing independent generators instant market access

As we work with independent generators across a wide range of technology types, we are helping them explore flexible hedging strategies that enable them to maximise price opportunities and generate revenue by simply interacting with the wholesale market.

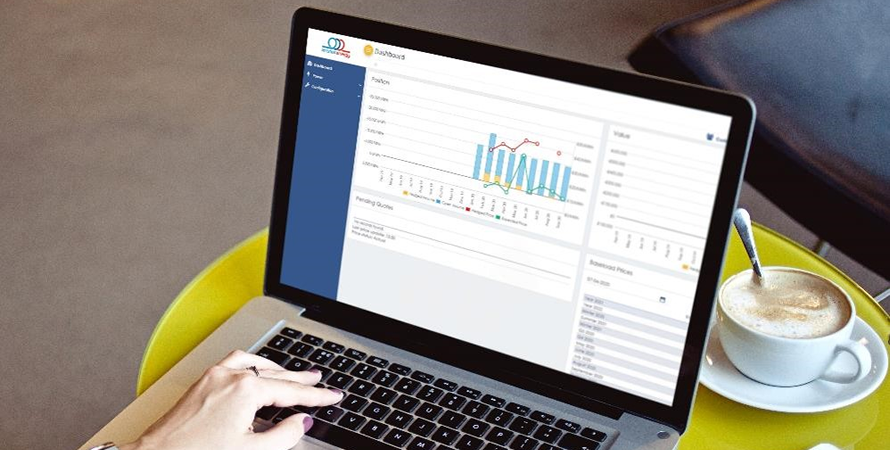

The SmartFlex PPA Trading Portal offers an effortless digital trading experience provided by expert technology providers Jules Energy. Jos, CEO of Jules Energy joined me for a webinar in October 2020 and said:

“Since implementing the Jules Platform, SmartestEnergy is now able to digitise their traditional FlexiPPA product by developing SmartFlex, powered by JuleSmart. It enables their customers to track forward price curves, up to 5 years ahead, which are published on a daily basis and offers a “self-serve” online experience for customers to lock/unlock volume and transact instantly”.

We have now onboarded over 400MW capacity onto the SmartFlex portal and have received positive feedback from our customers on the functionality of the platform and the flexibility it offers.

With a roadmap in place for continual improvement with Jules and lots more to add to the portal, we look forward to giving even more independents instant access to the wholesale market.

Short-term energy markets

In last-month’s Power Market Update blog, we revealed prices in the short-term energy markets hit record highs as N2EX Day-Ahead prices soared above £1,000/MWh, just proving the value available for generators who have the flexibility to switch their assets on and off.

Our technology partners Origami Energy and Quorum enable us to trade our customers’ flexible assets in real-time to capture price spikes in short-term markets and other grid response services, such as ODFM (Optional Downward Flexibility Management).

As an example of revenue potential, the average revenues for assets that took part ODFM in 2020 were £3,000/MW (wind) and £4,000/WW (solar). It has been confirmed that the ODFM service will run again in 2021 throughout the summer months.

United States

United States Australia

Australia